Alabama

If you have unexpected expenses arise or you find yourself in need of cash before your payday, Cash Advance Loans Online can help. We provide online installment loans to people in Alabama to help them get the cash they need when they need it.

Installment loans are short-term loans that provide people with a small amount of cash that they agree to pay back over time. Residents of Alabama can obtain an installment loan from an online lender such as Cash Advance Loans Online. You can apply for and receive an approval 7-days a week in order to get the cash that you need. After you have been approved for your loan, you will have the money deposited directly into your bank account as soon as the next day.

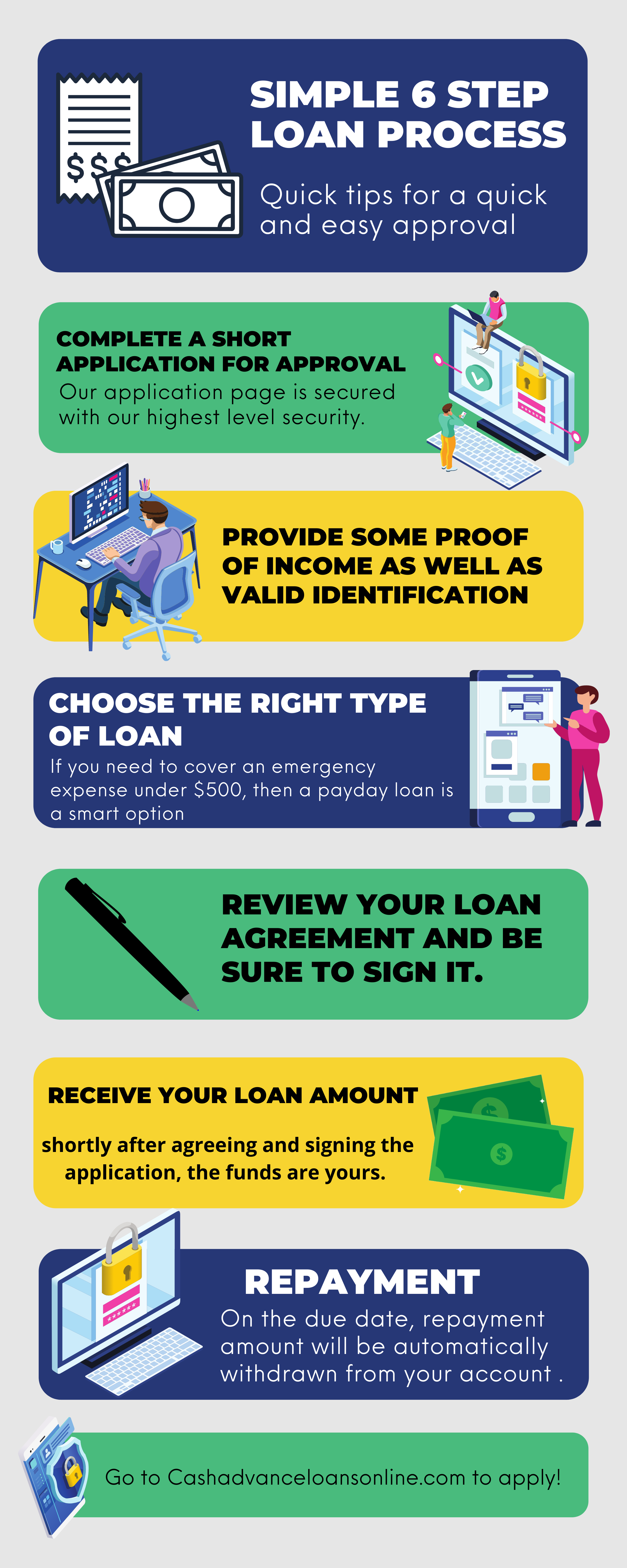

How Can I Quickly Get A Payday Loan?

Obtaining an online installment loan is simple. With a clear, 3-step process, you can have the funds you need, sometimes within 24 hours.

Step One

Submit your application online to apply for a loan.

Step Two

Get approved as soon as the same day.

Step Three

Get your cash fast. Your funds could be deposited directly into your bank as soon as the day of your approval.

What Are The Requirments For A Payday Loan?

Understanding the rates and terms for an online loan is essential. Knowing what you’re getting, what you’ll owe, and how long you have to pay the loan back, is an important part of getting a loan with Cash Advance Online Loans.

Loan Amount

The amount that someone can borrow for a loan varies depending on the state and type of online loan. In Alabama, installment loans can be between $2,000 and $2,600., while payday loans have a maximum of $500. After you complete your online application, you’ll be informed of your approval amount.

Loan Terms

In Alabama, installment loans have a term of 18 months. Your payments will be made as often as you are paid. Those who are paid bi-weekly or weekly will make 36 installment payments, while those who are paid monthly will have a total of 18 installment payments. Payday loans have a maximum term of 31 days, and often must be paid back by the borrower’s next pay day.

Cost of Loan

These small, fast-approval loans have a maximum annual percentage rate of 220%. The APR you pay will depend on your payment schedule and will be clear in your loan agreement. It’s important to be aware that installment loans have high interest and are therefore a very expensive type of credit. They tend to cost borrowers a great deal more than the amount they receive.

Loan Renewal

If you are struggling to pay your loan, we could potentially offer a loan renewal. With this option, you would pay an additional deferred presentment fee. If you request a loan renewal, we highly recommend making a partial payment on the loan balance.

The maximum fee that can be charged in Alabama for a deferred presentment is 17.5% of the cash that is advanced. During deferred presentment, no other fees may be charged, except for in the case of a bounced check. When a bad check is written as a deferred presentment payment, you may be charged a fee of up to $30.

Cash Advance Loans Online is a licensed lender in Alabama. While we serve people residing in most states, we obtain all necessary licensing and meet all essential requirements to lend in each state.

Are Online Payday Loans Legal In Alabama?

Installment loans, payday loans, and short-term loans are legal in Alabama. Installment loans have a maximum of $2,600 that can be borrowed, while payday loans have a maximum of $500. Payday loans must be paid back within 31 days. Terms will be located in the contract between the borrower and Cash Advance Loans Online.

What Do I Need In Order to Get a Payday Loan?

You will need to be able to prove that you are at least 18 years old. Through your application, you will need to provide identification, have an active bank account, and show that you have a steady income with regular payments. You will also need to prove that you are a US citizen or permanent resident.

Oftentimes, credit does not matter when you are applying for a payday loan or installment loan. Many lenders will choose to not do a credit check. Typically, bad credit is not going to prevent you from getting a payday loan or installment loan. Instead, lenders are far more interested in whether or not you have a steady income and the ability to make your loan payments.

Are Payday Loans and Installment Loans the Same Thing?

Payday loans and installment loans have similarities but are two entirely different types of loans. Payday loans are short-term loans designed to be paid back on the following payday. Installment loans are a bit higher in the amount they can lend. They pay back the loan in smaller installment payments over time.

Can I Pay Off My Loan Early?

When you pay off your loan quickly, you will likely have lower interest charges and you won’t have any penalties. You can also make early payments or larger payments in order to pay down the principal balance of the loan.

If you find yourself in a situation where you need cash fast, turn to Cash Advance Loans Online. With payday loans, installment loans, and short-term loans available, we help people get the cash that they need. We know that life happens and sometimes unexpected circumstances require quite a bit of work. That’s why we offer online payday and installment loans. Please visit: cashadvanceloansonline.com to find out if you’re eligible for a loan. Get your life back on track today.